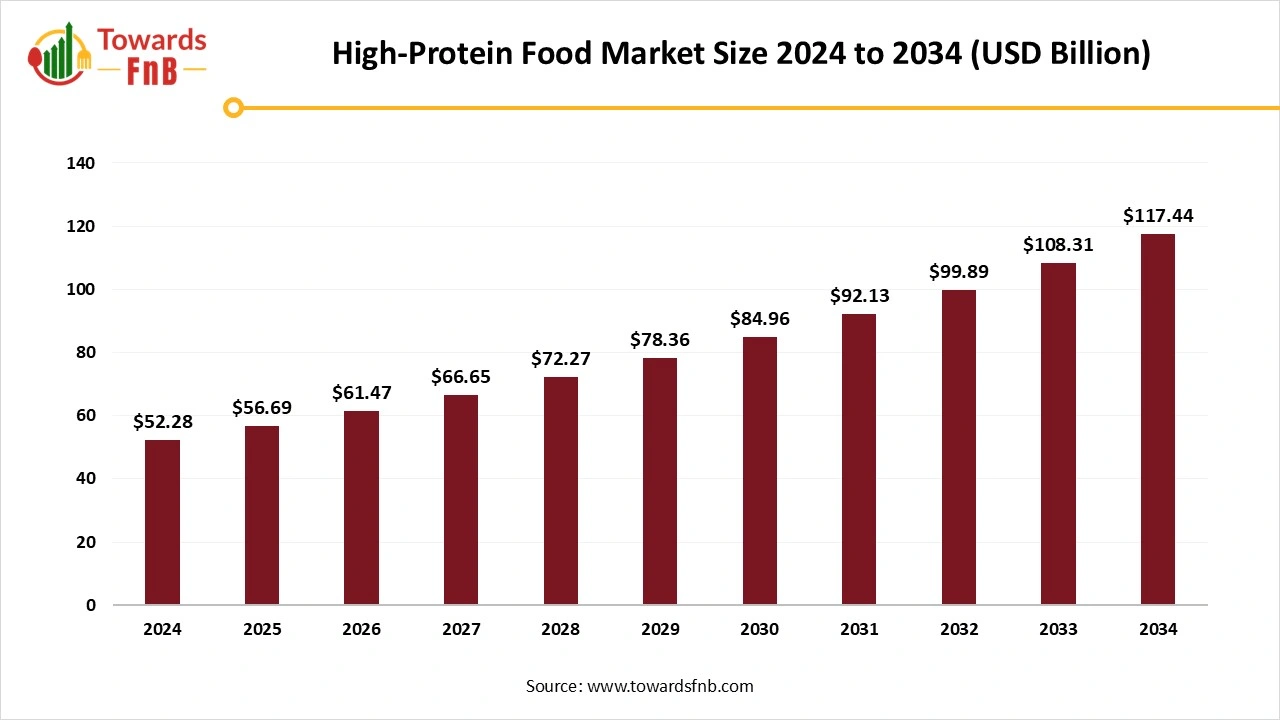

High-Protein Food Market Size to Hit USD 117.44 Billion by 2034, Fueled by U.S. and Asia Growth

According to Towards FnB, the global high-protein food market size is calculated at USD 56.69 billion in 2025 and is projected to surpass around USD 117.44 billion by 2034, representing a healthy CAGR of 8.43% during the forecast period from 2025 to 2034.

Ottawa, July 17, 2025 (GLOBE NEWSWIRE) -- The global high-protein food market size was valued at USD 52.28 billion in 2024 and is expected to grow from USD 56.69 billion in 2025 to around USD 117.44 billion by 2034, expanding at a CAGR of 8.43% from 2025 to 2034, according to study published by Towards FnB, a sister firm of Precedence Research.

The high-protein food market has grown substantially in recent years due to consumer awareness about the rising importance of high-protein foods and their benefits for weight management and overall health nutrition. The increasing fad for plant-based protein food options is also helping the market to grow as it is supported by the huge consumer base formed by vegans and consumers with dairy intolerance.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5540

Market Overview

The high-protein food market has grown substantially in recent years due to rising awareness among consumers about the benefits of high protein foods consumption for overall health. Consumers today prefer protein-rich food options for better weight management and to maintain general health as well. Such health conscious attitude has given rise to a high demand for protein-rich food items such as dairy products and lentils. Veganism and dairy intolerance have also led to the growth of the plant-based protein industry.

- Consumers with such health concerns are inclined towards plant-based protein to meet their nutritional requirements. Plant-based protein is also gaining huge popularity as people prefer to intake sustainable food options and also are aware of the health risks related to fatty dairy and meat products rich in fat and bad cholesterol.

The high-protein food market is also observing growth due to factors such as rapid urbanization, improving standard of living, and consumer awareness about adequate protein intake. Hence, the food industry has also incorporated protein-rich snacks and drink options for consumers to maintain their protein intake on the go. Consumers can also find plant-based protein food and snack options for vegans and people with dairy intolerance. Such options help people to maintain their nutritional intake during busy schedules as well.

Innovation in Protein Foods: Market’s Largest Opportunity

Innovation in high-protein foods can help the high-protein food market grow in the foreseen period. The availability of protein-rich snacks and drinks allows consumers to consume them on the go while traveling or when outdoors. It is essential for consumers who have busy schedules and are unable to maintain their protein intake by having and cooking proper meals. A significant portion of this demand comes from millennials and Gen Z, who prioritize functional nutrition and healthy snacking. According to a 2024 NielsenIQ survey, over 60% of Gen Z consumers actively seek foods with added protein, and nearly 70% of millennials report consuming protein snacks daily.

Key Highlights of High-Protein Food Market

- By region, North America dominated the high-protein food market due to high consumer demand for plant-based protein in the region.

- By region, Asia Pacific is expected to be the fastest growing region due to high awareness about high-protein foods and enhancing urbanization.

- According to product insights, the high-protein packed foods segment dominated the market in 2024 due to the ease and convenience provided to consumers with hectic schedules.

- According to product insights, the high-protein drinks segment is expected to be the fastest growing as it is the easiest form of high protein consumption.

- By distribution channel insights, the offline segment dominated the market in 2024 due to the fad of high-protein foods for overall well-being.

- By distribution channel segment, the online segment is observed to be the fastest-growing segment because of the easy availability of such foods on different e-commerce platforms.

Key Innovations & Instances in Production Innovation High-protein Food Market:

- Ready-to-drink (RTD) protein shakes and protein bars are dominating retail shelves. Brands like Premier Protein and RXBAR have seen double-digit sales growth due to rising demand for clean-label, high-protein options.

- Plant-based protein innovations, using pea, chickpea, and rice proteins, have expanded the market to vegan and flexitarian consumers. Companies like No Cow and Orgain are leveraging this shift.

- Protein-enhanced everyday foods such as pasta, chips, yogurt, and even ice cream (e.g., Halo Top) are allowing consumers to integrate more protein into their routine without changing eating habits drastically.

- The rise of high-protein breakfast options like Greek yogurt, protein pancakes, and fortified cereals has addressed the nutritional gap for busy mornings.

Major Product Types in High-Protein Food Market:

-

Protein-Rich Dairy Products

- Greek yogurt

- Protein-fortified milk

- Cheese and cottage cheese

-

High-Protein Snacks

- Protein bars

- Trail mixes with added protein

- Roasted chickpeas, nuts, and seeds

-

Ready-to-Drink (RTD) Protein Beverages

- Protein shakes

- Protein smoothies

- Meal replacement drinks

-

Protein-Rich Meat & Poultry Products

- Jerky (beef, turkey, chicken)

- Processed meat with added protein

- Lean cuts with high protein claims

-

Egg & Egg-Based Products

- Hard-boiled eggs (pre-packaged)

- Liquid egg whites

- Protein omelets and wraps

-

High-Protein Bakery & Breakfast Items

- Protein muffins, pancakes, and waffles

- Fortified cereals and granola

- Protein bagels and breads

-

Plant-Based Protein Products

- Tofu and tempeh

- Plant-based meat alternatives

- Lentil, pea, or chickpea-based items

Gain Comprehensive Market Insights – Download the Full Databook Today: https://www.towardsfnb.com/download-databook/5540

What are Latest Trends in High-Protein Food Market?

- Innovation in protein foods is helping the growth of the high-protein food market. Today consumers can buy protein-rich snacks, drinks, food options, and other similar options to manage their protein intake on the go even after a busy schedule.

- Increased muscle mass due to high protein consumption helps in strength training encouraging the growth of the high-protein food market.

- Protein consumption helps one to stay fuller for a longer time and avoid unhealthy snacking. Hence, it leads to the growth of high-protein snacks and beverage consumption as well.

- Consumption of protein also helps in multiple health benefits such as healthier bones and managing blood pressure as it helps in lowering bad cholesterol levels.

Market Dynamics

What are the Growth Drivers of the High-Protein Food Market?

One of the biggest growth drivers of the high-protein food market is consumer awareness about the benefits of protein intake. It helps in increasing muscle mass, keeping one fuller to control unhealthy cravings, strengthen bones, and manage blood pressure. Hence, consumers today prefer the intake of protein-rich snacks and beverages rather than oily, fried, and sugary snacks. Hence, the availability of protein-rich snacks and food options easily in online and offline stores is another major driver of growth of the market. The availability of plant-based protein options helps vegans to maintain their protein even while traveling or outdoors. Plant-based protein snacks such as protein bars, chips, crisps, dips, and drinks help the segment lead the market.

How Does Consumer Skepticism Cause Challenge for High-protein Food Market?

A high amount of protein consumption can cause multiple health issues. High amounts of protein foods involve full-fat dairy foods and fatty cuts. Excess consumption of such foods may increase cholesterol in the body causing blood pressure issues, heart problems, and various similar health risks. Intake of more than required protein and less fibre also causes constipation and stomach disorders. Hence, such obstructions can be barriers to the growth of the high-protein food market.

High-Protein Food Market Regional Analysis

Which Region Dominated the High-protein Food Market in 2024?

North America led the high-protein food market in 2024, consumers in the U.S. and Canada drove demand for both animal- and plant-based protein snacks, powders, and beverages. Protein-rich foods align with strong fitness-focused wellness trends and widespread innovation in clean-label product lines. This shift is also evident in consumer behavior: between 2023 and 2024, online searches for "high protein" surged 39%, demonstrating deep and rising demand for protein-rich foods

What to Expect from United States in High-protein Food Market?

- The U.S. protein landscape is rapidly evolving with expectations for further growth. Protein-enriched dairy products, notably cottage cheese reached USD 1.75 billion in sales, rising 18% year-over-year, fueled by TikTok-led recipe trends.

- Overall U.S. protein consumer behavior reflects escalation: 61% of U.S. consumers increased protein intake in 2024, up from 48% in 2019.

- Meat proteins remain essential, but protein-fortified snacks, functional foods, and plant-alternatives are rapidly expanding, offering broad category opportunities.

How are Asian Countries Expanding in High-protein Food Market?

Asia Pacific is seen to grow at the fastest rate during the forecast period, with countries like India, China, and Japan leading the charge. India accounted for a substantial share in region’s whey protein market, while China followed closely with a notable one supported by the booming e-commerce sector and increasing demand for fortified foods.

Additionally, plant-based proteins dominate nearly 60% of the APAC market, particularly in China and Southeast Asia, due to a strong cultural inclination toward vegetarian diets and sustainability. Innovations in algae, insect-based, and microbial proteins are also gaining traction.

The region’s expanding fitness culture, coupled with convenient high-protein snacks and beverages, is fueling demand especially among millennials and Gen Z consumers. With government-backed nutrition initiatives and robust product development, Asia Pacific is poised to remain a key driver of growth in the high-protein food landscape.

Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 8.43% |

| Market Size in 2024 | USD 52.28 Billion |

| Market Size in 2025 | USD 56.69 Billion |

| Market Size by 2034 | USD 177.44 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

High-Protein Food Market Segmental Analysis

Product Analysis

The high-protein packed foods segment dominated the high-protein food market in 2024 due to the convenience provided by the segment to avoid cooking but still consume protein easily. Such convenient food options help consumers complete their protein intake of the day without the hassle of cooking meals. It is a boon for consumers with busy and hectic schedules. Protein-rich snacks such as protein bars, chips and crisps, dips, and protein drinks are gaining popularity due to their easy consumption and convenience to carry them easily outdoors or while traveling while ensuring health at the same time. It helps consumers to stay fuller for a longer time and avoid oily, fried, and sugary snacks.

The high-protein drinks segment is observed to grow notably in the foreseen period as it is the easiest option to consume protein on the go without the hassle of cooking meals or arranging for appropriate ingredients. The segment is also helping the growth of the high-protein food market as consumers are always in search of protein-rich hydration options before and after a workout session. Protein-rich shakes and smoothie are some of the easy beverage options that help consumers maintain their protein intake of the day easily and keep a tap on their weight management options.

Distribution Channel Analysis

The offline segment of the high-protein food market dominated the market in 2024 through means such as gyms, convenience stores, health shops, and other similar places. It helps consumers to shop for different types of products under one roof and save time. It also allows consumers to get some professional health advice from professionals and clear any health doubts as well.

The online segment of the high-protein food market expects notable growth in the expected timeframe as it is a convenient way to order high-protein foods from different e-commerce platforms. At such platforms, consumers can also get to look at some discounted product options and order the right product at the right prices. Such platforms help consumers order protein-rich foods at the convenience of sitting at home.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Gluten Free Food Market: The global gluten free food market size is increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Food Market: The global canned food market size was reached at USD 122.72 billion in 2024 and is anticipated to reach USD 181.66 billion by 2034, growing at a CAGR of 4% over the next decade.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 214.32 billion in 2025 to USD 347.01 billion by 2034, at a CAGR of 5.50% over the forecast period.

- Sugar-Free Food Market: The global sugar-free food market size is expected to grow from USD 48.14 billion in 2025 to USD 83.2 billion by 2034, growing at a CAGR of 6.27% during the forecast period from 2025 to 2034.

- Vegan Food Market: The global vegan food market size is anticipated to grow from USD 22.38 billion in 2025 to USD 55.88 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Snack Food Market: The global snack food market size is expected to increase from USD 265.95 billion in 2025 to USD 468.76 billion by 2034, growing at a CAGR of 6.50% throughout the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is on a growth trajectory, with its valuation expected to nearly double over the next decade rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034.

Key players in the High-Protein Food Market

- Nestlé S.A. (Switzerland)

- Danone S.A. (France)

- Glanbia plc (Ireland)

- Archer Daniels Midland Company (ADM) (U.S.)

- PepsiCo, Inc. (through its brand Quaker Oats) (U.S.)

- Cargill, Incorporated (U.S.)

- Hormel Foods Corporation (U.S.)

- Tyson Foods, Inc. (U.S.)

- The Kraft Heinz Company (U.S.)

- Unilever PLC (U.K.)

- Kerry Group plc (Ireland)

- General Mills, Inc. (U.S.)

Recent Developments in High-Protein Food Market

-

In April 2025, India’s biggest FMCG brand, Amul, launched the world’s first high-protein kulfi. The low-fat, prebiotic kulfi, has no added sugar and is healthy for consumers of all age groups.

(Source- https://nuffoodsspectrum.in/2025/04/28/amul-launches-highest-protein-kulfi.html)

-

In April 2025, Nestle launched its new protein drink to support weight loss for GLP-1 medication consumers. The science-backed protein drink helps manage appetite, build muscle mass, and control sugar levels.

Segments Covered in the Report

By Product

- High-Protein Packed Foods

- High-Protein Drinks

- Protein Supplements

By Distribution Channel

- Online

- Offline

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/price/5540

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor

For Latest Update Follow Us: https://www.linkedin.com/company/towards-food-and-beverages

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.